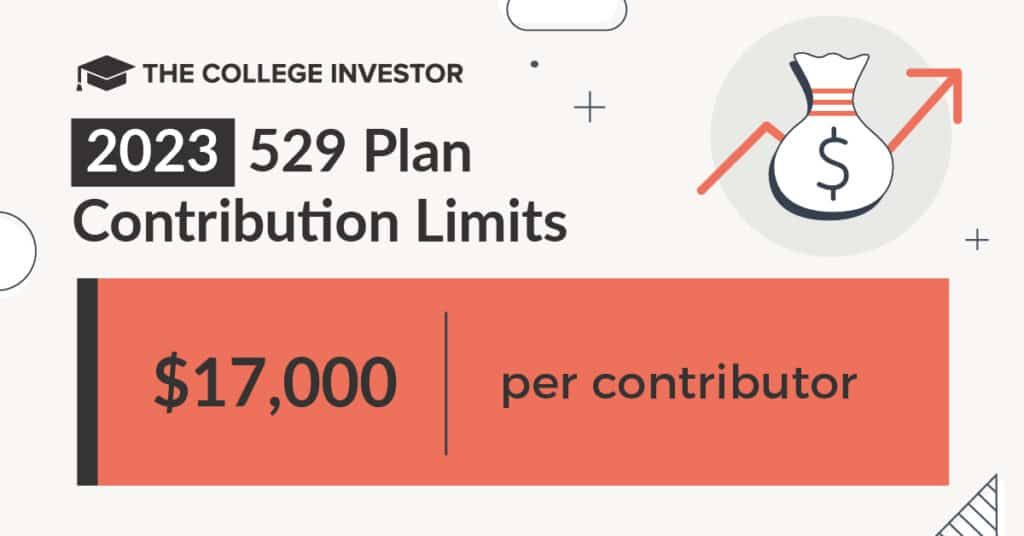

Ny 529 Contribution Limits 2025. How much should you have in a 529 plan by age; You can contribute up to $18,000 per year ($36,000 if married filing jointly) without triggering federal gift taxes.

529 Plan Contribution Limits For 2025 And 2025, What’s the contribution limit for 529 plans in 2025? This means your combined contributions toward both plans can’t exceed that.

529 Plan Contribution Limits in 2025, In 2025, the annual 529 plan contribution limit rises to $18,000 per contributor. Beginning january 1, 2025, rollovers will be permitted from a 529 plan account to a roth ira without incurring federal income tax or penalties, subject to specific conditions set forth in.

529 Plan Contribution Limits Rise In 2025 YouTube, So, using today’s limit, it would take you 5. What’s the contribution limit for 529 plans in 2025?

:max_bytes(150000):strip_icc()/529-plan-contribution-limits-2016.asp_Final-28fe6ce80ec7400fb9e62e35624d8c2b.jpg)

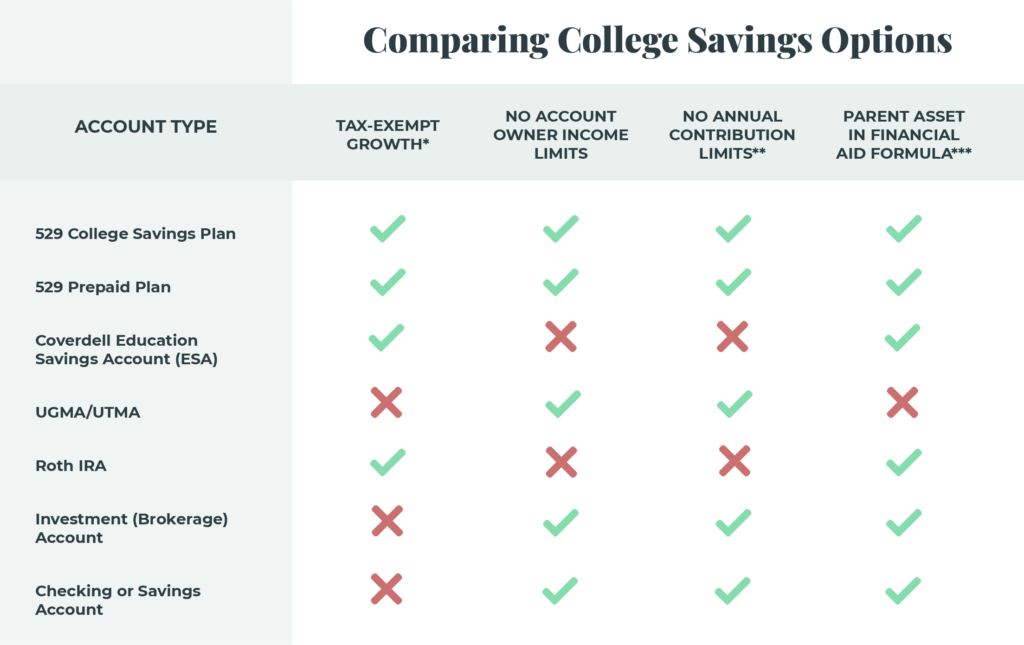

529 Plan Maximum Contribution Limits By State Forbes Advisor, Starting in 2025 — thanks to “ secure 2.0 ,” a slew of measures affecting retirement savers — families can roll unused money from 529 plans over to roth. The amount you can roll over from a 529 plan into a roth ira account is subject to the annual roth ira contribution limits set by the irs.

50 Unbelievable Benefits of a 529 Plan Ultimate Guide 2025, In 2025, the annual 529 plan contribution limit rises to $18,000 per contributor. One of the many benefits of 529 plans is there is no federal.

529 Plan Contribution Limits (How Much Can You Contribute Every Year, Good news, while there is a maximum aggregate 529 plan contribution limit, there is no annual 529 plan contribution limit! If both rollovers are done this year for a total of $13,500 ($6,500 for 2025 + $7,000 for 2025 = $13,500) and there are, for example, three beneficiaries with unused.

2025 HSA & HDHP Limits, Create a legacy of education. One of the many benefits of 529 plans is there is no federal limit on the amount you can contribute.

529 Contribution Limits 2025 All you need to know about Max 529, Previously, distributions from a grandparent’s 529 plan were reported as untaxed student income, which could reduce aid eligibility by up to 50% of the amount of the. There are restrictions limiting who can do these.

529 Plan Contribution Limit 2025 Millennial Investor, 529 plans and state tax benefits. Create a legacy of education.

NY’s 529 College Savings Webinar Uniformed Firefighters Association, New york 529 plans have. 529 plans and state tax benefits.

You can contribute up to $18,000 per year ($36,000 if married filing jointly) without triggering federal gift taxes.